Over 1 Million Hospitals Clinics And Physicians Worldwide. Ad Compare Top Expat Health Insurance In Indonesia.

Self Employment Health Insurance Cost And How To Save Up To 30 With This Tip Nj Insurance Plans Mike Sheeran Cfp

Self Employment Health Insurance Cost And How To Save Up To 30 With This Tip Nj Insurance Plans Mike Sheeran Cfp

The annual policy premiums are 10000.

Self employed health insurance cost. Silver and Gold plans on the exchange have average premiums that range from 483 to 569 a month. Get Free Quotation Buy Online Now. Ad Extensive Motor Insurance Policy.

Free Results 247 For You. There is a large range of insurance deductible as well as co-pay alternatives so you are likely to be able to locate a plan to fulfill your monetary requirements. Joe may deduct the 10000 as a business expense for his consulting practice.

He may deduct the 10000 not only from his 100000 income for income tax purposes but also from his self-employment income as well. This is the equivalent of buying a health insurance plan similar to how you would buy a cell phone plan. Marketplace savings are based on your estimated net income for the year youre getting coverage not last years income.

The average health insurance cost for an individual plan is about 388 per month. EHealth found that individuals who purchased a Bronze plan on the health insurance marketplace paid an average monthly premium of 448 without subsidies. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

4328 for individuals and 8352 for families. Ad Self health insurance cost. Ad Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority.

Ad Compare Top Expat Health Insurance In Indonesia. Self-employed workers over age 65 may qualify for Medicare Health Insurance. You can only take the 12000.

He saves 4500 in federal and state taxes by taking this deduction. Get Free Quotation Buy Online Now. Note that individuals and families may qualify for Obamacare subsidies that can decrease the premium they must pay dramatically.

When youre self-employed it can be hard to estimate your income for the coming months or year. For example if your business earned 12000 but premiums cost you 15000 you cant claim the entire 15000. Stacey Aikman director of marketing for Vista360health estimates that self-employed workers in central Texas typically pay between 200 and 400 per month for health insurance.

However seniors who want supplemental health insurance would need to pay the premiums for those plans out of their own pocket. Ad Self health insurance cost. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

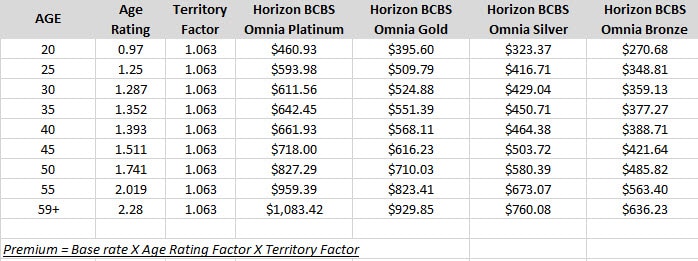

Ad Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority. The average health insurance premium for a policyholder at 45 is 289 up to 1444 times the base rate and by 50 its up to 357 which comes out to 1786 x 200. Self Employed Health Insurance If you are self-employed and work independently you can purchase individual health insurance.

Get An Expat Quote Today. Get An Expat Quote Today. Supplemental health insurance plans include special insurance for Medicare Part B and Part D or Medicare Advantage Health Insurance plan.

Get the Best Quote and Save 30 Today. When you fill out a Health Insurance Marketplace application youll have to estimate your net self-employment income. Free Results 247 For You.

Over 1 Million Hospitals Clinics And Physicians Worldwide. Ad Extensive Motor Insurance Policy. Possibly you have children that need insurance coverage or youre attempting to make best use of the number of discount rates you can get.

Get the Best Quote and Save 30 Today. Health insurance for the self-employed is any insurance plan purchased as an independent contractor or self-employed individual where you are required to cover the cost. Nec metus sed donec.

The cost of health insurance for freelancers depends on several factors such as where you live your income level and the size of your deductible. After age 50 premiums rise. Average premium for families without Obamacare subsidies.

How much does self-employed health insurance cost. Your self-employment income is calculated on Schedule C or F and it must be equal to or exceed the amount of your health insurance deduction.