You work for someone who pays you. Ad Find info on MySearchExperts.

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

Reforming The Earned Income Tax Credit And Additional Child Tax Credit To End Waste Fraud And Abuse And Strengthen Marriage The Heritage Foundation

2016 Earned Income Tax Credit Eligibility Requirements Once you determine if you are eligible for the EITC here are the maximum credit amounts that you might qualify for in 2016.

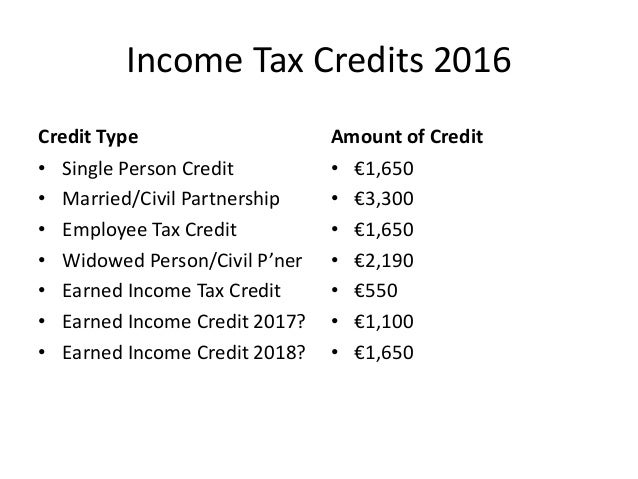

Earned income credit 2016. Earned income includes all the taxable income and wages you get from working or from certain disability payments. Notice to Employees of Federal Earned Income Tax Credit EIC If you make 47000 or less your employer should notify you at the time of hiring of the potential availability of Earned Income Tax Credits or Advance Earned Income Credits. However the maximum credit you can claim between the two is 1650 so the earned income credit is now restricted to 450.

Have a valid Social Security number not an ITIN for yourself your spouse if filing jointly and any qualifying children on your return. What is 2016 Earned Income Credit. Whats New for 2016 Earned income amount.

506 with no Qualifying Children 3373 with 1 Qualifying Child. How much is the earned income tax credit for 2016 What was the earned income credit for 2016. You own or run a business or farm.

You may be able to take the credit if. Have been a US. Earned Income Credit 2016 SCHEDULE EIC Qualifying Child Information 43 Child 1 Child 2 Child 3 1 Childs name 2 Childs SSN 3 Childs year of birth 4 a b 5 Childs relationship to you 6 Number of months child lived with you in the United States during 2016 Qualifying Child Information Form 1040A or 1040 Yes.

Earned Income Credit The Earned Income Credit is available since 1 January 2016. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children. The IRS urges workers who work for someone else or own or run their own business or farm and earned 53505 or less in 2016.

Millions of workers may qualify for the first time this year due to changes in their marital parental or financial status. Phaseout Threshold Amount Begins for Single SS or Head of Household 8270. The amount of EITC benefit depends on a.

Earned Income Credit. Earned Income Tax Credits are reductions in federal income tax liability. Those who qualify for EITC for tax year 2016 can get a credit from.

Search for Tax credit rd at MySearchExperts. 10 to 5572 with two qualifying children. Maximum 2016 Earned Income Tax Credit Amount.

Millions of workers may qualify for the first time this year due to changes in their marital parental or financial status. Ad Find info on MySearchExperts. Read down the At leastBut less than columns and find the line that includes the amount you were told to look up from your EIC Worksheet earlier.

When you file a tax return you could get a refund of federal taxes withheld. To qualify for and claim the Earned Income Credit you must. The Earned Income Tax Credit EITC is a financial boost for people working hard to make ends meet.

It is a separate credit to the Employee Tax Credit in that it can also be claimed by people who are self-employed. When can I expect my refund with EIC 2020. There are two ways to get earned income.

2016 Earned Income Tax Credit. You have three or more qualifying children and you earned less than 47955 53505 if married filing jointly You have two qualifying children and you earned. Search for Tax credit rd at MySearchExperts.

Taxpayers with low earnings by reducing the amount of tax owed on a. 2 to 503 with no qualifying children. Phaseout Amount When Credit Ends for Single SS or Head of Household 14880.

Taxable earned income includes. It is allowed in respect of the pay that you earn. You could also get an additional cash refund known as EITC.

Examples of income that qualifies for the earned income credit includes. If you get the full PAYE credit you will not get any Earned Income Credit as its not possible to claim both. Not have investment income exceeding 3650.

Earned Income lower limit required to get maximum credit. Citizen or resident alien for the entire tax year. What Is the Earned Income Credit.

This is not a tax table. The Earned Income Tax Credit EITC is a tax benefit for working people who earn low or moderate incomes. 9 to 3373 with one qualifying child.

Earned Income Tax Credit 2016 Put some extra money in your pocket What is the Earned Income Tax Credit. Wages salaries tips and other taxable employee pay. Trading income Case I and II and.

The earned income credit EIC is a refundable tax credit that helps certain US. 2016 Earned Income Credit EIC Table CAUTION. Follow the two steps below to find your credit.

The Earned Income Tax Credit EITC is a financial boost for people working hard to make ends meet. The maximum amount of income you can earn and still get the credit has increased.