Quickly find the maximum home price within your price range. Debt-to-income affects how much you can borrow.

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000.

How much house can i be approved for. On a 250000 house. Continental baseline is 548250. There is a rule of thumb about how much you can afford based on the calculations your mortgage provider will make.

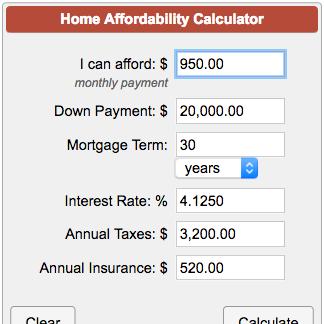

Use them to determine the maximum monthly mortgage payment of principle and interest and the maximum loan amount for which you may qualify. DTI ratio reflects the relationship between your gross monthly income and major monthly debts. Here are a few documents you should gather to help you understand your financial situation and how much house you can afford.

Conforming limits are adjusted every year by the FHFA. 36000 of gross income less fixed monthly expenses. Most home loans require a down payment of at least 3.

But please understand its a calculator only and the official number will be determined by a mortgage lender. The monthly mortgage payment would. How much down payment you need for a house depends on which type of mortgage you get.

Down payments can also vary by the amount you want to borrow as well as factors like credit history. In case someone is able to pay over the next 30 years a monthly payment 500 for a mortgage loan lets assume different interest rate levels and see how much house he can afford. If your credit score is below 580 youll need.

For example if your loan amount is 400000 your mortgage is considered a conforming conventional loan. You pay on interest. The most important consideration is How much house can I afford.

In most parts of the country income cannot be more than 86850. Make sure to check their website to know the current loan limits. You may qualify for a loan amount of 252720 and your total monthly mortgage payment will be 1587.

42000 of gross income less fixed monthly expenses. You can afford a home up to. Your total mortgage payment should be no more than 28 of your gross monthly income.

The debt-to-income ratio DTI is your minimum monthly debt divided by your gross monthly income. Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. Each loan program has different rules regarding the down payment required.

As of 2021 the maximum conforming limit for single-family homes throughout the US. Some programs such as the zero-down USDA mortgage have income limits on who can qualify. This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can qualify for.

You can afford to borrow. Good Credit the lesser of. Since your cash on hand is 55000 thats less than 20 of the homes price.

The most popular mortgage a conventional loan starts at 3 to 5 down. 28000 of gross income or. Medium Credit the lesser of.

Thats because even with all the angst involved in applying for and being approved for a home loan lenders are often. It looks like you may be able to afford a home worth about 386405 for a payment of about 1300 per month mo. To afford a house that costs 150000 with a down payment of 30000 youd need to earn 22382 per year before tax.

36000 of gross income or. Our calculator uses the information you provide about your. Using the calculation methods above you could qualify for.

To calculate how much home you can afford with a VA loan VA lenders will assess your debt-to-income ratio DTI. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross houshold income. How much house can I afford for 500 a month.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. This calculator uses these guidelines for determining how much house you can afford which are similar to common underwriting criteria that mortgage lenders use. This information will also be required when you apply for a pre-approved.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. FHA calculators help you determine how much you can afford to safely borrow in order to finance your home.

Home Affordability Calculator Money

Home Affordability Calculator Money

How Much House Can I Afford Get Pre Approved Today

How Much House Can I Afford Get Pre Approved Today

If I Make 50k A Year How Much House Can I Afford Mortgage Rates Mortgage News And Strategy The Mortgage Reports

If I Make 50k A Year How Much House Can I Afford Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Affordability Calculator How Much House Can I Afford Zillow

Affordability Calculator How Much House Can I Afford Zillow

I Make 70 000 A Year How Much House Can I Afford The Answer

I Make 70 000 A Year How Much House Can I Afford The Answer

How Much House Can I Afford The Wealth Hound

How Much House Can I Afford The Wealth Hound

How Much House Can I Afford Forbes Advisor

How Much House Can I Afford Forbes Advisor

![]() How Much House Can I Afford Interest Com

How Much House Can I Afford Interest Com

How Much House Can You Afford Money Under 30

How Much House Can You Afford Money Under 30

Here S How To Figure Out How Much Home You Can Afford

Here S How To Figure Out How Much Home You Can Afford

How Much House Can I Afford Credit Com

How Much House Can I Afford Credit Com

How Much House Can I Afford Rocket Mortgage

How Much House Can I Afford Rocket Mortgage

How Much House Can I Afford 5 Ways To Calculate Your Number

How Much House Can I Afford 5 Ways To Calculate Your Number

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.